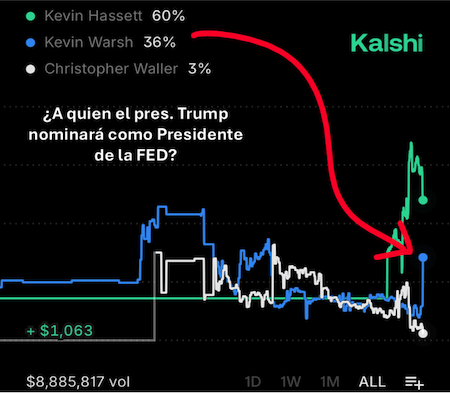

VoxBox930 is a newsletter that simplifies financial markets, investing, and the global economy. Today, prediction markets (like Kalshi.com) moved sharply after reports that Trump now leans toward Kevin Warsh to head the Fed, although Kevin Hassett remains very much in the race. What's going on and what's the real difference between them? The short version: less than it seems. Kevin Warsh — ex-Fed, 'Wall Street' profile. Kevin Hassett — economist and official Trump advisor. Pro-growth, more comfortable with cuts and not holding back the economy out of fear of inflation. What's the big practical difference? Once in the chair, both would operate within the same framework: committee decisions (they don't call the shots alone), focus on inflation and employment, and a lot of market pressure. In other words: the tone might change… but the music is pretty similar. Key data point: Trump made it clear he wants a Fed president more willing to cut rates and who 'listens to him.' No robots, no novices: we're real people with actual experience in financial markets here. Lots of political noise, moving bets, and headlines… but for the markets, the Fed's overall direction would change less than Twitter/X believes. Activists — investors who buy stocks to push for changes in strategy, leadership, or corporate governance — are disproportionately targeting female CEOs. Focused on credibility; tougher on inflation before, now open to cutting rates. VoxBox translation: Lots of political noise, moving bets, and headlines… but for the markets, the Fed's overall direction would change less than Twitter/X believes. Activists — investors who buy stocks to push for changes in strategy, leadership, or corporate governance — are disproportionately targeting female CEOs. Focused on credibility; tougher on inflation before, now open to cutting rates. Kevin Hassett Economist and official Trump advisor. Promise: we won't clutter your inbox — just one email a week, in the morning, with useful information. For more content like this, subscribe here: https://www.voxbox930.com/subscribe?utm_source=snip&utm_medium=email&utm_campaign=snip The opinions expressed in this article are solely the responsibility of the author. Pro-growth, more comfortable with cuts and not holding back the economy out of fear of inflation. What's the big practical difference? Once in the chair, both would operate within the same framework: committee decisions (they don't call the shots alone), focus on inflation and employment, and a lot of market pressure. In other words: the tone might change… but the music is pretty similar. Key data point: Trump made it clear he wants a Fed president more willing to cut rates and who 'listens to him.' No robots, no novices: we're real people with actual experience in financial markets here. Lots of political noise, moving bets, and headlines… but for the markets, the Fed's overall direction would change less than Twitter/X believes. Activists — investors who buy stocks to push for changes in strategy, leadership, or corporate governance — are disproportionately targeting female CEOs. Focused on credibility; tougher on inflation before, now open to cutting rates. VoxBox930: is a newsletter that simplifies financial markets, investing, and the global economy.