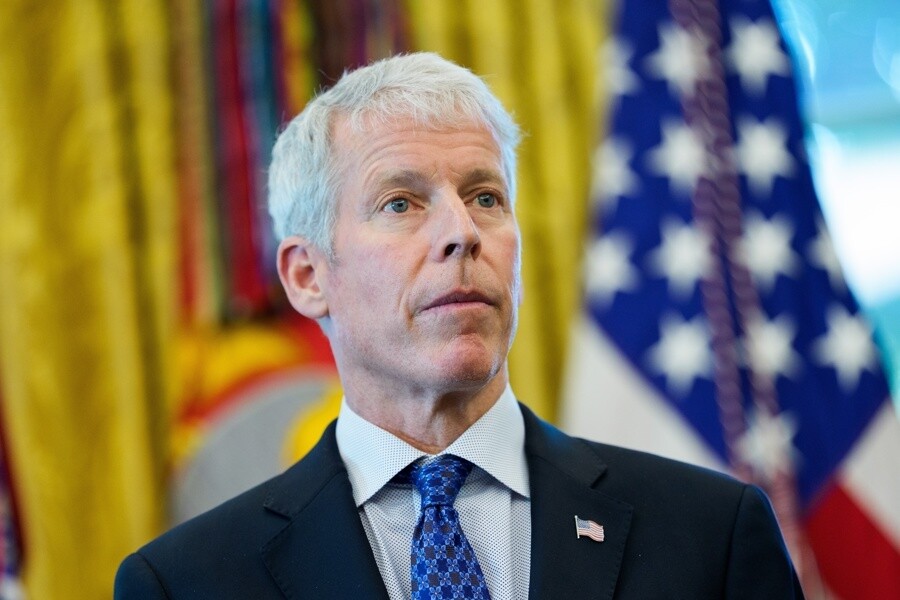

The US Secretary of Energy, Chris Wright, stated on Sunday that American oil companies Chevron and Shell, Spanish Repsol, and Italian ENI will "immediately" increase their investments in Venezuela following a meeting with US President Donald Trump. "We had Chevron, Shell, Repsol, and ENI, four of the world's largest oil companies, saying: 'immediately, we will start raising our investments and growing our production.' I have a team of American oil hunters who say they will go there this week," he told Fox News. Wright's statements come after Friday's meeting between Trump and oil executives at the White House, where the president asserted there will be investment of "at least $100 billion of their own capital, not government money," to revitalize Venezuela's infrastructure. Although Repsol's CEO, Josu Jon Imaz, told Trump the company is prepared to "invest heavily in Venezuela," the meeting highlighted the intervention of Exxon's CEO, Darren Woods, who opined that the South American country "is not investable today." However, Wright asserted that Exxon's opinion is "atypical," claiming there are "at least a dozen" companies ready to return to Venezuela after the US military intervention that led to the capture of President Nicolás Maduro a week ago. "This includes 'five big' companies that are 'already there and will quickly increase their production, and probably another six to a dozen' that are 'ready to enter.' "So the speed at which we will see investment and change in Venezuela's production trajectory is impressive," the secretary stated. Energy analysts have expressed skepticism toward Trump's plan for Venezuela, which has the world's largest reserves, equivalent to 364 billion barrels or 17% of the total, but whose production represents only 1% of the global total, according to Standard & Poor's (S&P) data. Among the cited reasons for the skepticism are the obsolescence of Venezuelan infrastructure and political uncertainty, as the interim president of Venezuela is Delcy Rodríguez, who was Maduro's vice president and an official of the late leader Hugo Chávez, who nationalized oil. In this context, Trump declared a "national emergency" on Saturday to protect US Treasury accounts from revenue from Venezuelan oil sales, which would prevent creditors of Venezuela's external debt from claiming the funds. Following the oil expropriation, there have been nearly 60 arbitrations against Venezuela since 2000 for a total estimated value of $30 billion, almost 15% of its international debt, according to data from Columbia University's Center on Global Energy Policy (CGEP).